RTA Credit Card – Emirates Islamic nol Card

Are you a frequent user of public transport in Dubai? If yes, then the Emirates Islamic RTA Card might be the perfect fit for you. RTA Credit Card is a multi-purpose card specifically designed for Dubai’s public transport users, allowing them to use it as a nol card as well as a normal credit card. You can earn points, cashback rewards and enjoy discounts on RTA services using this nol credit card. Let’s explore the fees, features, and benefits in the below article.

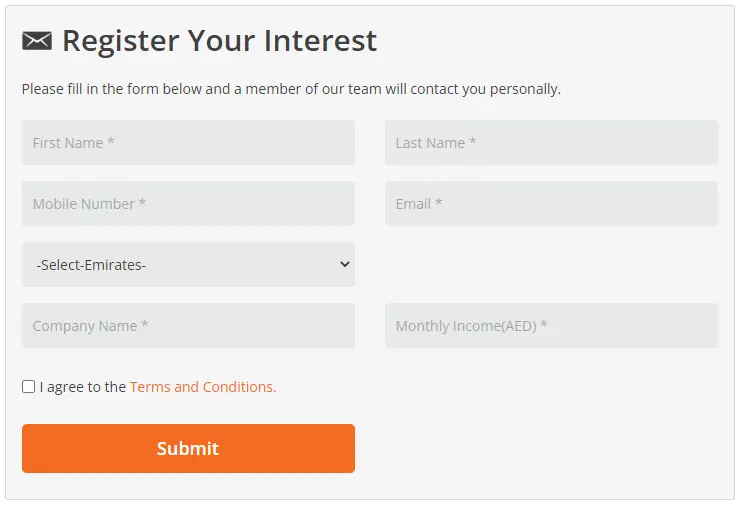

How to Apply for Emirates Islamic RTA Card

To apply for the RTA Credit Card, you can visit the Emirates Islamic website.

1. Visit the Emirates Islamic official website or click here to apply for a nol credit card

2. Enter the required details and submit to proceed further

Eligibility

To apply for an RTA credit card first, you should follow the eligibility criteria given below:

- You should have a valid Emirates ID

- The minimum age required must be 21

- Your Minimum salary should be at least 5000 AED

Fees and Rates of Emirates Islamic RTA Card

There is no annual fee on The Emirates Islamic nol Card but it charges a 3% interest rate on cash advances, with a minimum fee of AED 99. For non-AED transactions, the fee is 3.49%.

Activate its auto top-up facility

The auto top-up facility lets you auto-recharge your nol card using a credit card without any hassle of a manual process.

- When you purchase a nol credit card, select the option ” activate auto top-up facility”

- Enter your nol card details such as “nol tag ID” and other required details

- Once done, it’ll be recharged every time automatically

- You can also choose the plan according to your need among 50 AED, 100 AED, and 200 AED plans

If you forget to activate auto top-up while purchasing the card, you can do it later by calling customer care at +971 600 599995.

How to Recharge Emirates Islamic RTA Card

You can recharge your nol Card using any of the following recharge methods, such as Emirates Islamic cash deposit machines, Emirates Islamic ATM, Emirates Islamic online banking, Emirates Islamic mobile banking, Emirates Islamic IVR, RTA ticket offices, Ticket vending machines, RTA authorized sales agents, and RTA customer care center.

1. Recharge RTA Credit Card through EI Cash Deposit Machines

- Visit your nearest Emirates Islamic cash deposit machine

- Insert your RTA credit card in CDM and enter your 4 digit pin code

- Enter 10 digit nol tag ID printed on the backside of your nol card

- Insert the money you want to recharge in CDM and press enter/confirm

- Re-confirm the details provided and confirm to complete the recharge process

2. Recharge RTA Credit Card through EI ATM

- Insert your nol credit card into Emirates Islamic ATM and enter your 4 digit pin code

- Select Other Services

- Then select Bill Payments

- Then select Roads and Transport Authority

- Then select nol Recharge

- Enter 10 digit nol tag ID printed on the backside of your nol card

- Enter the amount you want to recharge and press enter/confirm

3. Recharge RTA Credit Card through EI Online Banking

- Visit the Emirates Islamic Online website and log in

- Select RTA under Payments

- Select nol Recharge

- Add your nol tag ID in Add Beneficiary option

- Note: You may be asked some security questions while adding a beneficiary, answer them accordingly

- Once the beneficiary is added, you will receive a code on your registered mobile number

- Enter that code

- Enter the name of the beneficiary and nol tag ID printed on the backside of the Go4it Debit Card

- Click Pay Now to complete the process

4. Recharge nol Credit Card through EI Mobile Banking

- Install the EI Bank app for Android or IOS/iPhone

- Register with your required details or Log in with your user ID

- Follow the steps to recharge your RTA credit card

5. Recharge nol Credit Card through EI IVR or Customer Care Service

- Call Emirates Islamic customer care at +971 600 599995

- Select the language

- In this step, the representative may ask for your account number, 16 digit Card number, and PIN

- Select nol Recharge option

- Enter 10 digit nol tag ID printed on the backside of your nol card

- Re-confirm the details provided and confirm

- Now, you will receive an Authentication Code and a Reference No. in your registered mobile number

- Enter these to proceed further

- Enter the amount to be recharged and press 1 to complete the process

6. Recharge nol Credit Card through RTA Channels

You can also recharge your Emirates Islamic nol Card through different RTA channels such as Ticket offices located at metro stations, Ticket vending machines, RTA authorized sales agents, RTA smart apps, and smart top-up solar machines.

Features and Benefits of Emirates Islamic RTA Card

RTA credit card is a multipurpose card for everyone living in the UAE. It allows you to use it as a nol card as well as a regular credit card. That means you can pay for your transportation and withdraw advance cash from the same card. Some major benefits and features of nol credit card are given below:

1. Built-in nol Card

Emirates RTA Islamic Card has built-in nol cards. You can use this card the same like nol card for all accepted transactions such as transport, shopping at supermarkets, paying for government services, and pharmacies.

2. Fare Payments

You can pay for fares while traveling via the RTA metro, RTA bus, and RTA water bus, and also pay for parking. You can also buy weekly, monthly, and yearly passes using the Emirates Islamic nol card.

3. Cashback Rewards on RTA Transactions

The Emirates Islamic nol Card or RTA Credit Card offers cashback rewards on RTA transactions. Cardholders can earn 10% cashback on Dubai Metro, Dubai Tram, RTA buses, and water buses, and 5% cashback on RTA taxi fares.

4. Discounts on Other RTA Services

Cardholders can enjoy discounts on RTA services, including 50% off on RTA vehicle registration and 25% off on Salik tags.

5. Cashback Rewards on Other Purchases

In addition to RTA transactions, Cardholders can earn 0.5% cashback on all other purchases at supermarkets And 10% cashback at the fuel station.

6. Lounge Access

Emirates Islamic Banking (EIB ) RTA card has lounge access across different countries. Using your Emirates Islamic Bank Skywards Black Credit Card gives you unlimited and complimentary access to over 1,000 global airport lounges. This offer is valid for you, the credit card holder, and a guest. Lounge access is complimentary or discounted for you and your guest, depending on your Emirates Skywards membership and class of travel. You can also enjoy paid access to our lounges in Dubai and selected lounges worldwide.

7. Complimentary Roadside Assistance

Cardholders can also enjoy complimentary roadside assistance, including fuel delivery, battery boost, and tire change. This service is available 24/7 and can be accessed by calling the helpline.

8. Offers on Cinema Tickets

One of the exciting features of the Emirates Islamic nol Card is the complimentary cinema offer. Cardholders can enjoy up to two “Buy 1 Get 1” movie tickets each month, any day of the week. However, a minimum monthly retail spend of AED 3,000 is required to avail of this benefit. If the spending criteria are not met or the maximum complimentary ticket usage is exceeded, the credit card will be billed accordingly.

9. Protection of Purchase:

You can now protect your purchases against theft or accidental damage. Allowing you to focus on shopping rather than focusing on protection.

How to Redeem Cashback Rewards

Emirates Islamic RTA Card provides you cash back Redeem, which you can get by using the following steps:

- Log in to your Emirates Islamic account through Online Banking or Mobile Banking.

- Click on ‘Cards’.

- Tap on ‘Rewards’.

- Select Resumption and submit your request.

- Now, you can enjoy your rewards by redeeming with Emirates Islamic whenever and wherever you want.

FAQs

Conclusion

The Emirates Islamic RTA Card is a great option for anyone who frequently uses public transportation and RTA services in Dubai. With its cashback rewards, discounts, and other benefits, the card can help you save money on your daily commute and other expenses. If you meet the eligibility criteria, applying for the card is as simple as we disscussed to apply for nol blue card and can be done online or through any other option that we’ve discussed in the article. So, if you want to make your transportation expenses more affordable and enjoy other perks, consider applying for the Emirates Islamic nol Card today. If you have any queries related to the RTA credit cards, you can comment down below.

Can someone reach me at 0525162938 so I can discuss further on the card and then buy.

You can ask anything in the comment box, I will do my best to guide you about nol.

Is the 10% fuel cash back available only in dubai petrol stations or also in abu dhabi and other emirates?

10% cashback is available all over the UAE.

nol card have airport lounge access

The Skywards Black Credit Card offers you entry to over 1,000 global airport lounges.

Hi, Is the EI Nol card is beneficial for paying traffic fine?